If you’ve ever wondered why invest in stocks, or why financial experts emphasize investing in stocks, the answer lies in their potential to generate long-term wealth. Unlike savings accounts or bonds, stocks historically deliver higher returns and provide a unique opportunity to harness the power of compound interest. In this article, we’ll explore why stocks remain one of the best investments for building wealth, and how compounding can turn small investments into life-changing sums.

Why Invest in Stocks?

Higher Returns Compared to Other Assets

Over the past century, the U.S. stock market, measured by the S&P 500, has delivered an average annual return of about 7–10% after inflation. In comparison, bonds and savings accounts typically yield only 2–4%. This long-term performance makes stocks an essential part of wealth creation.

Ownership in Companies

When you buy shares, you’re buying ownership in a business. If the company grows, your share of its profits grows too. Unlike a bond coupon, this growth is unlimited — there’s no cap on how much a company can expand (theoretically).

Inflation Hedge

Inflation reduces the value of money over time. Stocks, however, represent businesses that can raise prices, innovate, and expand, making them a natural inflation hedge.

Liquidity and Accessibility

Today, anyone can buy or sell stocks instantly through online brokers. This makes investing in stocks one of the most accessible ways to participate in wealth-building.

The Power of Compound Interest

What is Compound Interest?

Compound interest means earning returns not only on your initial investment but also on the returns that investment has already generated. In simple terms: it’s interest on interest.

The formula for compound growth is:

Where:

- A = future value of investment

- P = principal (initial investment)

- r = annual interest rate (as a decimal)

- n = number of compounding periods per year

- t = time (years)

Example of Compounding

Let’s say you invest $10,000 in the stock market with an average annual return of 8%.

- After 10 years: ~$21,589

- After 20 years: ~$46,610

- After 30 years: ~$100,627

- After 40 years: ~$217,245

The curve starts slow but accelerates dramatically in later years — this is the magic of compounding.

Why Time in the Market Matters

The earlier you start investing, the more time compounding has to work its magic. Consider two investors:

- Investor A invests $10,000 at age 25.

- Investor B invests $10,000 at age 35.

Both achieve the same 8% return, but Investor A ends up with more than double by retirement age because of starting earlier.

This demonstrates the importance of time in the market, rather than timing the market and why to invest in stocks.

Risks of Investing in Stocks

Of course, stocks come with risks:

- Volatility: Prices fluctuate daily.

- Market downturns: Crashes and recessions happen.

- Company-specific risks: Not every stock succeeds.

How to Manage Risk

- Diversification: Spread investments across sectors and regions.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly to smooth out entry points.

- Long-Term Perspective: Market downturns are temporary; over decades, stocks trend upward.

How to Get Started Investing in Stocks

- Open a brokerage account with a trusted platform.

- Start small and invest consistently (even $100/month makes a difference).

- Reinvest dividends to maximize compounding.

- Consider low-cost ETFs or index funds if you don’t want to pick individual stocks.

Investing in stocks is one of the most effective ways to build long-term wealth. The key is compound interest — allowing your money to grow exponentially over time. The earlier you start, the more powerful compounding becomes.

Don’t wait for the “perfect time” to invest. Instead, start today, stay consistent, and let time and compounding work in your favor.

How to Calculate Compound Interest in Excel (or Google Sheets)

Let’s see how we can calculate compound interest in Excel.

You can also use the compound interest calculator from: Investor.gov.

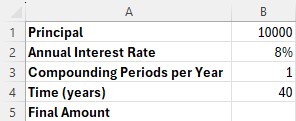

First, structure your Excel spreadsheet with the following labels and cells:

- Cell A1: “Principal”

- Cell A2: “Annual Interest Rate”

- Cell A3: “Compounding Periods per Year”

- Cell A4: “Time (years)”

- Cell A5: “Final Amount”

Next, enter your values:

- Cell B1: Enter your principal amount (e.g., 10000)

- Cell B2: Enter your interest rate(e.g., 0.08 or 8%)

- Cell B3: Enter the number of compounding periods per year (e.g., 1 for yearly)

- Cell B4: Enter the time in years (e.g., 40)

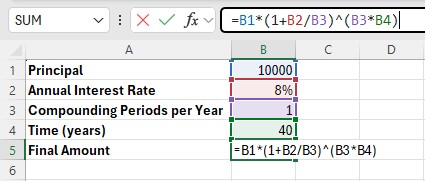

Finally, in cell B5, enter the compound interest formula:

=B1*(1+B2/B3)^(B3*B4)

Now imagine if you add a monthly contribution of $500 per month.

Instead of approximately $217,000 you would have a whopping $1.7 million.